How To Manage Inflation With Your Small Business

Rising costs pose a great challenge for small business owners. As inflation affects the economy, it can lead to increased expenses that threaten your bottom line. Navigating this economic landscape requires strategic planning and a proactive approach.

Every small business needs a robust plan to manage inflation. It’s essential to understand how inflation affects various aspects of your operations, from supply chain costs to pricing strategies. Adapting quickly to these changes can be the difference between thriving and merely surviving.

The key to managing inflation lies in being adaptable and resourceful. By staying informed about economic trends and implementing effective strategies, you can safeguard your business against the adverse effects of rising prices. Join us as we explore practical steps and innovative ideas to help you manage inflation and ensure your business remains resilient in uncertain times.

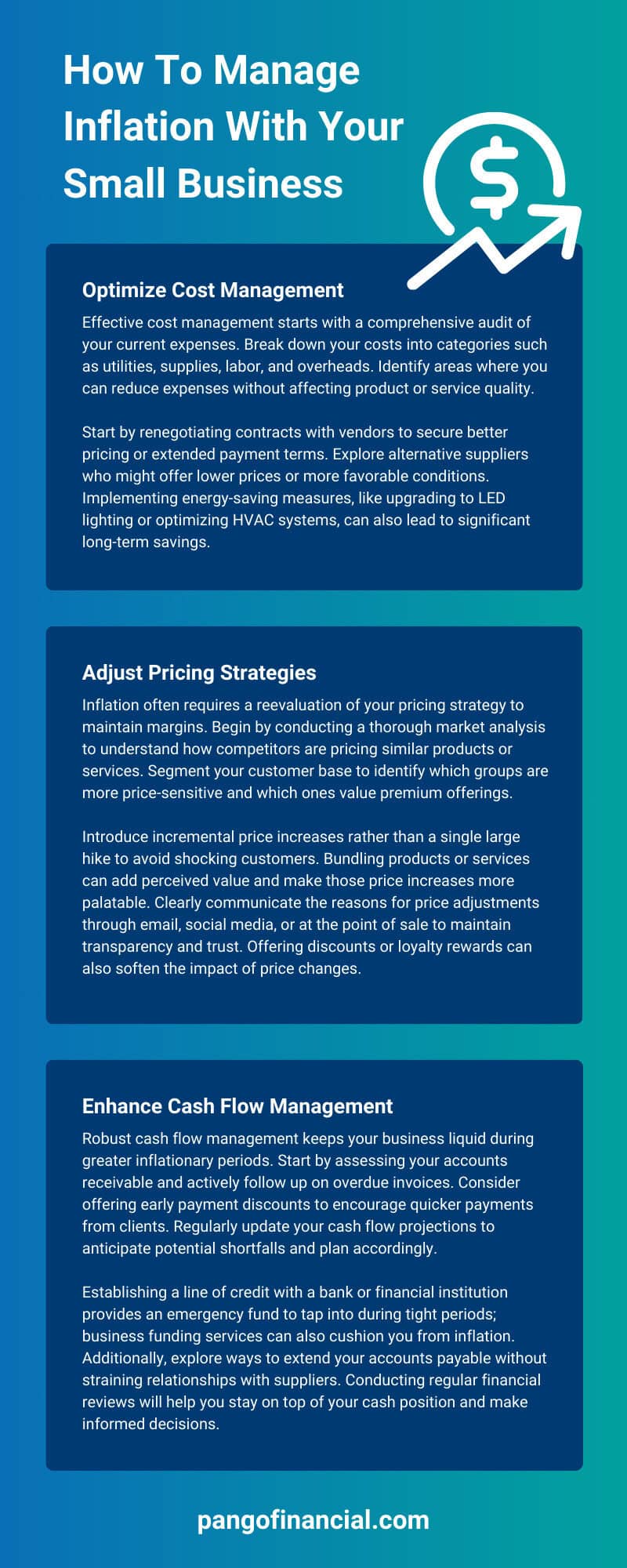

Optimize Cost Management

Effective cost management starts with a comprehensive audit of your current expenses. Break down your costs into categories such as utilities, supplies, labor, and overheads. Identify areas where you can reduce expenses without affecting product or service quality.

Start by renegotiating contracts with vendors to secure better pricing or extended payment terms. Explore alternative suppliers who might offer lower prices or more favorable conditions. Implementing energy-saving measures, like upgrading to LED lighting or optimizing HVAC systems, can also lead to significant long-term savings.

Adjust Pricing Strategies

Inflation often requires a reevaluation of your pricing strategy to maintain margins. Begin by conducting a thorough market analysis to understand how competitors are pricing similar products or services. Segment your customer base to identify which groups are more price-sensitive and which ones value premium offerings.

Introduce incremental price increases rather than a single large hike to avoid shocking customers. Bundling products or services can add perceived value and make those price increases more palatable. Clearly communicate the reasons for price adjustments through email, social media, or at the point of sale to maintain transparency and trust. Offering discounts or loyalty rewards can also soften the impact of price changes.

Enhance Cash Flow Management

Robust cash flow management keeps your business liquid during greater inflationary periods. Start by assessing your accounts receivable and actively follow up on overdue invoices. Consider offering early payment discounts to encourage quicker payments from clients. Regularly update your cash flow projections to anticipate potential shortfalls and plan accordingly.

Establishing a line of credit with a bank or financial institution provides an emergency fund to tap into during tight periods; business funding services can also cushion you from inflation. Additionally, explore ways to extend your accounts payable without straining relationships with suppliers. Conducting regular financial reviews will help you stay on top of your cash position and make informed decisions.

Diversify Revenue Streams

Reduce your reliance on a single source of income. Begin by analyzing your current offerings and identifying gaps where additional products or services can be introduced. Consider launching complementary products that align with your existing offerings.

For example, if you run a bakery, adding a catering service or baking classes could attract new customers. Expanding into new markets, either geographically or through online sales channels, can also broaden your customer base. Subscription models or membership programs offer steady, predictable revenue. Regularly review market trends to identify emerging opportunities and adjust your offerings accordingly.

Invest in Technology and Automation

Take advantage of tech advancements to yield substantial long-term savings and efficiency gains. Start by evaluating areas of your business that are labor-intensive or prone to errors. Automating repetitive tasks, such as payroll, invoicing, and inventory management, reduces human error and frees up staff for more strategic activities.

Implementing a modern customer relationship management (CRM) system can enhance customer interactions and improve retention. Advanced data analytics tools help you understand customer behavior and optimize marketing efforts. While the initial investment might be high, the reduction in operational costs and improvement in productivity will pay off over time.

Improve Inventory Management

How do you manage your inventory during inflationary times? Avoid tying up capital in unsold stock if at all possible. Implement a just-in-time (JIT) inventory system to minimize holding costs and reduce waste. Use sophisticated inventory management software to track stock levels in real time and forecast demand more accurately. Establish strong relationships with suppliers to ensure quick replenishment of stock when needed.

Regularly review your inventory turnover ratios to identify slow-moving items and discontinue or discount them to free up cash. Optimizing your storage practices can also reduce damage and spoilage, further controlling costs.

Focus on Customer Retention

Keeping your existing customers is more cost-effective than chasing new ones, especially during times of inflation. Providing exceptional service and consistent value keeps your current customers loyal.

Start by implementing a robust customer loyalty program that rewards repeat purchases with discounts, exclusive offers, or points that can be redeemed for products. Personalize your marketing efforts based on customer preferences and purchase history to create targeted promotions that resonate with consumers. Solicit feedback regularly to understand customer needs and adjust your offerings accordingly.

Pro Tip

Engaging with customers through social media and email newsletters keeps your brand top-of-mind and fosters a sense of community. Happy customers are more likely to tolerate price increases and continue their patronage.

Monitor Economic Trends

Regularly read industry reports and subscribe to economic newsletters to understand how broader trends could affect your business. Participate in local business groups, chambers of commerce, and industry associations to network with other business owners and share insights. Attend economic forums and seminars to gain expert perspectives on future inflationary pressures.

Use this information to adjust your business strategies, such as pricing, inventory management, and marketing efforts. Keeping a finger on the pulse of the economy helps you anticipate changes and make timely adjustments to safeguard your business.

What Now?

As inflation continues to shape the economic landscape, small businesses must remain agile and innovative. Beyond simply weathering the storm, view this period as an opportunity for growth and improvement. Inflation challenges conventional business practices, but it also opens doors for rethinking strategies, optimizing operations, and strengthening customer relationships.

Inflation presents undeniable challenges, but with strategic planning, thoughtful innovation, and community engagement, your small business can not only manage inflation but emerge stronger and more resilient. Embrace this period of change as a catalyst for improvement so your business is well-positioned for sustained success in any economic environment.

Want to learn more about financial options that can provide some protection from inflation? Pango Financial’s funding solutions tool is at your service.